Synthetic indices woh financial instruments hain jo real-world market conditions ko simulate karte hain bina kisi real events, jaise ki geopolitical developments, economic data releases, ya market hours ke prabhav ke. Yeh indices advanced algorithms ke madhyam se generate hote hain aur trading ke liye hamesha available rehte hain, jo traders ko ek consistent aur predictable environment dete hain.

Synthetic Indices ke Key Features

Volatility Consistency:

Traditional markets ke mukable, synthetic indices ek consistent volatility level maintain karte hain, jo traders ko market movements ko anticipate karne aur strategies develop karne mein asaan banata hai.

24/7 Availability:

Synthetic indices hamesha trading ke liye available hote hain, hafte ke saath din, 24 ghante, jo alag-alag time zones ke traders ke liye behtareen flexibility offer karta hai.

Transparency aur Fairness:

Algorithms jo synthetic indices generate karte hain woh market ko manipulation se door rakhte hain, ek fair trading environment dete hain.

Types of Synthetic Indices Offered on Deriv

Volatility Indices:

Yeh indices market volatility ko replicate karte hain, alag-alag intensity levels ke saath, jaise Volatility 10, 25, 50, 75, aur 100. Har index ek specific volatility percentage ko represent karta hai, jo traders ko apne risk tolerance ke mutabik choose karne ka mauka deta hai.

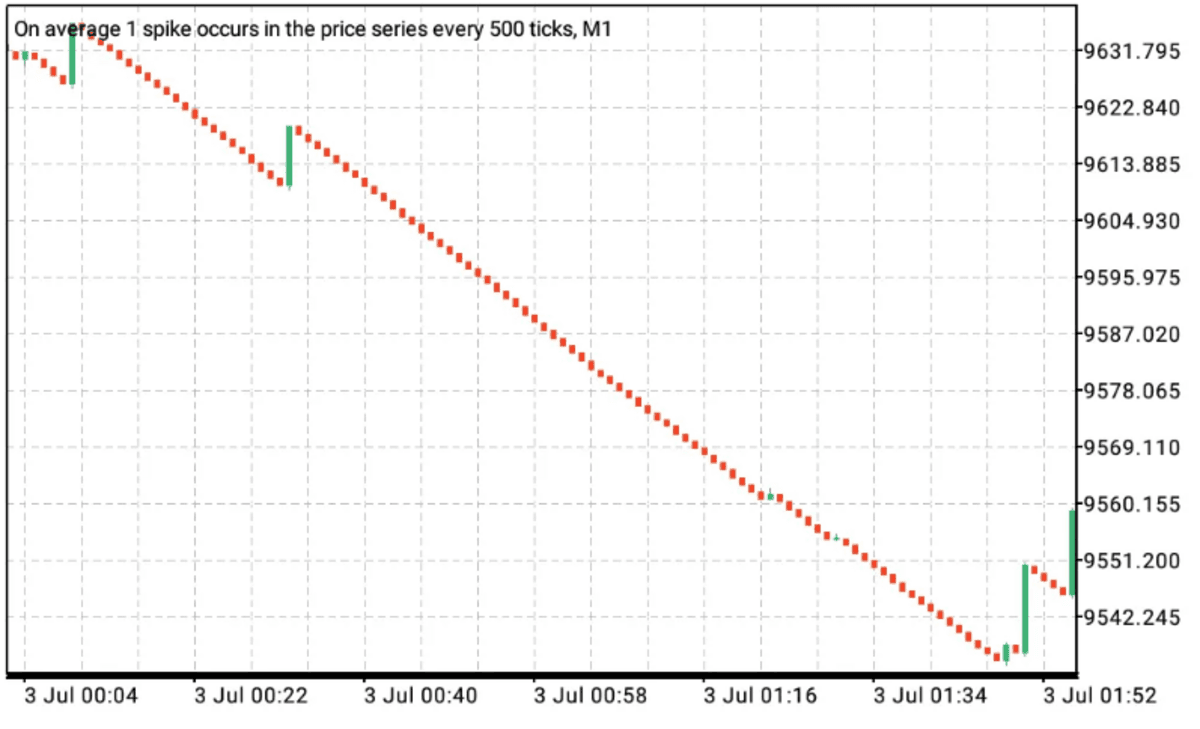

Crash aur Boom Indices:

Yeh indices sudden market crashes aur booms ko simulate karne ke liye design kiye gaye hain, jo rapid market movements par capitalize karne ke ichhuk traders ke liye exciting opportunities dete hain.

Range Break Indices:

Yeh indices markets ke specified ranges ko break karne wale behavior ko mimic karte hain, jo un traders ke liye ideal hain jo breakout strategies mein specialize karte hain.

Benefits of Trading Synthetic Indices

Predictable Market Behavior

Synthetic indices ka sabse bada fayda yeh hai ki unka predictable market behavior hai. Kyunki yeh political events ya economic reports jese external factors se prabhavit nahi hote, traders technical analysis aur algorithmic strategies par zyada bharosa kar sakte hain.

Enhanced Risk Management

Synthetic indices enhanced risk management opportunities dete hain. Consistent volatility levels traders ko precise risk management strategies implement karne mein madad karte hain, jaise ki stop-loss aur take-profit orders, jo zyada accuracy ke saath kiya ja sakta hai.

Accessibility aur Flexibility

24/7 availability ke saath, traders kabhi bhi synthetic indices ka access le sakte hain, jo unke liye ek behtareen choice hai jo busy schedules ke saath hain ya jo regular market hours ke baad trade karna chahte hain.

Beginners ke liye Educational Tool

Beginners ke liye, synthetic indices ek excellent educational tool ki tarah serve karte hain. Inka simplified aur predictable nature naye traders ko trading ke fundamentals sikhne, market behavior ko samajhne, aur strategies develop karne mein madad karta hai bina real-world market variables ki complexity ke.

How to Get Started

Account Banayein

Synthetic indices ka trade karna shuru karne ke liye, aapko Deriv.com par ek account banana hoga. Registration process seedha hai aur kuch hi minutes mein complete ho sakta hai.

Apne Account ko Fund Karein

Account set hone ke baad, agla step usse fund karna hai. Deriv.com alag-alag deposit methods offer karta hai, jaise credit/debit cards, e-wallets, aur cryptocurrencies, jo alag-alag regions ke traders ke liye flexibility dete hain.

Apna Index Choose Karein

Jab aapke account mein funds aa jate hain, tab aap woh synthetic index choose kar sakte hain jo aapke trading style ko suit kare. Deriv.com har index ke liye ek detailed description aur historical performance data provide karta hai jo aapko informed decision lene mein madad karta hai.

Trading Strategy Develop Karein

Ek robust trading strategy develop karna safalta ke liye zaroori hai. Deriv.com par demo account feature ka use karein bina real money ko risk mein daalein apni strategy practice karne ke liye. Yeh feature aapko experience aur confidence gain karne mein madad karta hai live trading par jaane se pehle.

Monitor aur Adjust Karein

Synthetic indices trading ke liye lagataar monitoring aur apni strategy mein adjustment zaroori hai. Deriv.com platform par available technical analysis tools aur indicators ka use karke market trends ko samjhein aur zaroori adjustments karein.

Conclusion

Synthetic indices financial trading ka landscape badal rahe hain, aur ek unique blend of predictability, accessibility, aur fairness offer karte hain. Chahe aap ek beginner ho jo trading sikhna chahte hain ya ek experienced trader ho jo consistent aur reliable trading opportunities dhundh rahe hain, Deriv.com par synthetic indices ek ideal platform offer karte hain. Synthetic indices ke saath trading ke future ko apnaayein aur apni financial success ka potential unlock karein.

Risk Sambandhi Jankari

Deriv complex derivatives offer karta hai, jaise options aur contracts for difference (“CFDs”). Ye products sabhi clients ke liye suitable nahi ho sakte hain, aur inka trading karna aapko risk mein daal sakta hai. Kripya trading karne se pehle in risks ko samajhna zaroori hai:

a) Aap trade mein apna kuch ya saara invested paisa khona sakte hain.

b) Agar aapka trade currency conversion involve karta hai, toh exchange rates aapke profit aur loss ko prabhavit karenge.

Aapko kabhi bhi borrowed paisa ya aisa paisa jo aap lose nahi kar sakte, uske saath trade nahi karna chahiye