Synthetic indices trading has emerged as a popular and innovative way for traders to engage in simulated market environments without the risks associated with traditional financial markets. Since its inception in 2016 by Deriv.com, synthetic indices have provided traders with a unique opportunity to trade in a controlled, fair, and transparent environment. Currently, the demand for synthetic indices trading continues to grow, making it essential for traders to understand how to trade synthetic indices effectively.

In this guide, we’ll explore what synthetic indices are, why they are gaining traction, and the best strategies to trade synthetic indices in 2025. Whether you’re a beginner or an experienced trader, this article will equip you with the knowledge to navigate this exciting trading asset.

What Are Synthetic Indices?

Synthetic indices are designed to replicate the price movements and volatility of actual financial markets without being tied to any underlying assets. They operate continuously, providing traders with 24/7 access, including weekends and public holidays. These indices are generated by cryptographically secure random number generators, ensuring constant volatility and independence from external market factors

Key features of synthetic indices include:

- Constant Volatility: Synthetic indices maintain a consistent level of volatility, making them predictable and easier to analyze.

- No Market or Liquidity Risks: Since they are not tied to real-world markets, synthetic indices are immune to external factors like economic news, geopolitical events, or liquidity issues.

- 24/7 Trading: Synthetic indices are available for trading around the clock, providing flexibility for traders in different time zones.

Why Trade Synthetic Indices in 2025?

As financial markets become increasingly unpredictable, synthetic indices offer a safe and reliable alternative for traders. Here are some reasons why trading synthetic indices in 2025 is a smart choice:

- No Fundamental Interference: Synthetic indices are not influenced by real-world events, making them ideal for traders who want to avoid the unpredictability of traditional markets.

- Fair and Transparent: The use of RNG ensures that all trades are fair and unbiased.

- Diverse Trading Options: Synthetic indices come in various types, including volatility indices, crash/boom indices, and jump indices, catering to different trading preferences.

- Risk Management: With constant volatility and no external risks, traders can better manage their strategies and minimize losses.

How to Trade Synthetic Indices in 2025

Trading synthetic indices requires a combination of technical analysis, risk management, and a solid understanding of the market. Here’s a step-by-step guide to help you get started:

1. Choose a Reliable Broker

To trade synthetic indices, you’ll need to sign up with a broker that offers these assets. Deriv.com is the pioneer in synthetic indices trading, but other platforms may also provide similar opportunities. Ensure the broker is regulated, offers a user-friendly platform, and provides educational resources.

2. Understand the Different Types of Synthetic Indices

Familiarize yourself with the various synthetic indices available:

- Volatility Indices: Simulate market volatility with constant price fluctuations.

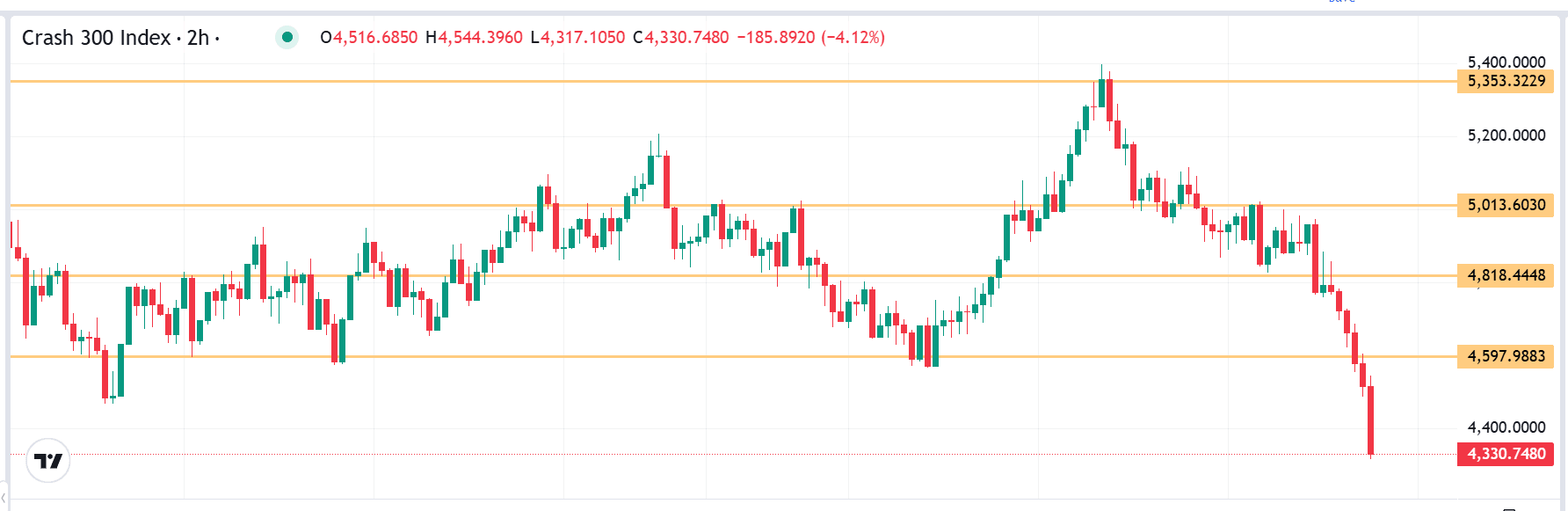

- Crash/Boom Indices: Mimic sudden market crashes or booms.

- Jump Indices: Represent markets with frequent price jumps.

Each type has its own characteristics, so choose the one that aligns with your trading style.

3. Develop a Trading Strategy

Successful trading requires a well-defined strategy. Here are some popular strategies for trading synthetic indices:

- Trend Following: Identify and follow trends in price movements.

- Range Trading: Trade within a specific price range, buying at support levels and selling at resistance levels.

- Scalping: Make quick trades to capitalize on small price movements.

4. Use Technical Analysis Tools

Leverage technical indicators such as moving averages, RSI, and Bollinger Bands to analyze price movements and make informed decisions.

5. Practice Risk Management

Even though synthetic indices are less risky than traditional markets, it’s crucial to manage your risk. Set stop-loss and take-profit levels, and never invest more than you can afford to lose.

6. Start with a Demo Account

Most brokers offer demo accounts where you can practice trading synthetic indices without risking real money. Use this opportunity to refine your strategies and build confidence.

7. Stay Updated and Adapt

The financial landscape is constantly evolving, and so should your trading strategies. Stay informed about new developments in synthetic indices trading and adapt your approach accordingly.

Tips for Successful Synthetic Indices Trading in 2025

- Stay Disciplined: Stick to your trading plan and avoid emotional decision-making.

- Keep Learning: Continuously educate yourself about trading strategies and market trends.

- Diversify: Don’t put all your capital into a single trade or index.

- Use Leverage Wisely: While leverage can amplify profits, it can also increase losses. Use it cautiously.

Conclusion

Synthetic indices trading offers a unique and exciting opportunity for traders to engage in simulated market environments without the risks associated with traditional markets. As we move into 2025, the popularity of synthetic indices is expected to grow, making it essential for traders to understand how to trade synthetic indices effectively.

By choosing a reliable broker, developing a solid trading strategy, and practicing risk management, you can maximize your chances of success in this innovative trading space. Whether you’re a beginner or an experienced trader, synthetic indices provide a fair, transparent, and flexible way to achieve your financial goals.

Risk Disclaimer

Deriv offers complex derivatives, such as options and contracts for difference (“CFDs”). These products may not be suitable for all clients, and trading them puts you at risk. Please make sure that you understand the following risks before trading Deriv products: a) you may lose some or all of the money you invest in the trade, b) if your trade involves currency conversion, exchange rates will affect your profit and loss. You should never trade with borrowed money or with money that you cannot afford to lose.